When confronting debt, it's crucial to comprehend the diverse consumer protection laws in place to protect your rights. These laws present a structure for addressing debt concerns fairly and transparently. Getting to know yourself with these legal safeguards can empower you to navigate this difficult financial situation more efficiently.

A good starting point is to explore the exact laws pertinent to your location. This may necessitate reviewing resources from government agencies, consumer advocacy groups, or a qualified legal professional.

Bear in mind that you have rights as a consumer, even when facing debt. By understanding these rights and the available resources, you can work to resolve your debt situation in a fashion that is both legal and fair.

Grasping Your Debt Resolution Options: A Comprehensive Guide

Facing overwhelming debt can be a daunting experience, leaving many individuals to feel stressed and hopeless. Luckily, there are a variety of debt resolution options available that can help you regain control of your finances. This comprehensive guide will delve into the most common methods, empowering you with the knowledge to make wise decisions about your financial future.

- Initially, we'll explore debt consolidation, a process that combines multiple debts into one obligation.

- Subsequently, we'll analyze the benefits of debt management plans, which involve working with a credit counselor to create a budget and negotiate lower interest rates.

- Furthermore, this guide will shed light on bankruptcy, a legal process that can provide a fresh start for those facing insurmountable debt.

By recognizing these various debt resolution options, you can opt for the strategy that best aligns with your unique circumstances and work towards achieving financial freedom.

Debt Settlement Programs: Pros, Cons, and Potential Pitfalls

Navigating debt difficulties can be daunting. Some of individuals find themselves buried under the weight of high debt. In these situations, people may consider debt settlement programs as a potential strategy. These programs offer negotiations with creditors to diminish the overall total owed. While debt settlement can potentially lift financial burdens, it's essential to recognize both its advantages and potential risks.

- Certain debt settlement programs can secure significant decreases in the total owed, providing support for debtors.

- A effective settlement can enhance your credit score over time by reducing your debt-to-income ratio.

- Despite this, it's important to note that debt settlement programs can have major harmful impacts on your credit score initially.

Be aware that debt settlement programs often demand expenses. These fees can differ depending on the program and the amount of debt you owe. Before enrolling in a program, it's essential to thoroughly examine the terms and grasp the potential financial implications.

- Moreover, debt settlement programs may not assure success. Creditors are not obligated to accept offers, and negotiations can be drawn-out.

- Certain individuals may find themselves encountering court proceedings from creditors if they miss payments on their debts.

In conclusion, debt settlement programs can may provide a solution to reduce overwhelming debt, but it's essential to approach them with caution. Thoroughly investigate different programs, contrast their terms, and speak with a credit expert to make an educated decision.

Optimizing Finances with Debt Consolidation Plans

Are you feeling overwhelmed by a multitude of unpaid debts? Debt consolidation can be a helpful tool to manage your financial stress. Vitamins for Hormonal Changes By gathering your various debts into a single payment, you can simplify your finances and potentially reduce your overall interest rates. Explore debt consolidation options to gain financial peace of mind.

- Research different consolidation loans.

- Talk to a credit counselor to identify the suitable plan for your circumstances.

- Create a financial plan to manage your expenses.

Safeguard Yourself from Unfair Debt Collection Practices

Dealing with debt collectors can be a trying experience, especially when you feel they are using unfair tactics. It's important to understand your rights and make steps to protect yourself from unscrupulous debt collection practices. First, always ask that any communication be in writing so you have a document of their statements. If you think a collector is acting illegally, reach out to your state's attorney general or the Consumer Financial Protection Bureau (CFPB) for help. Remember, you have rights and shouldn't hesitate to stand up for them.

- Remember that debt collectors are allowed to contact you by phone, mail, or email. However, they cannot abuse you or make threats.

- Be aware of your state's regulations regarding debt collection practices. These laws frequently provide additional protections for consumers.

- Document all interactions with debt collectors, including dates, times, and the content of conversations. This documentation can be essential if you need to refute their claims later.

Taking Control: Your Guide to Debt Management

Feeling overwhelmed by financial obligations? You're not alone. Many people struggle with debt, but the good news is that there are tools and resources available to help you get back on track. First by creating a financial roadmap to understand where your money is going. Look into debt consolidation to simplify payments and potentially lower interest rates.

- Contact a financial planner for expert advice.

- Research government programs designed to aid individuals in managing debt.

- Keep in mind that tackling debt takes time and effort, but with the right tools and resources, you can achieve financial freedom.

Josh Saviano Then & Now!

Josh Saviano Then & Now! Kirk Cameron Then & Now!

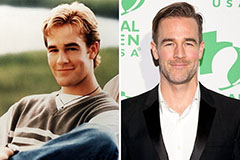

Kirk Cameron Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Bo Derek Then & Now!

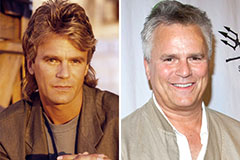

Bo Derek Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!